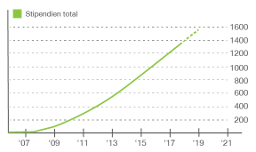

Our clear focus on sustainable impact and newly launched goal to empower 1'000 Young Entrepreneurs have allowed us to take the lead.

Blog

Invest in Tomorrow’s Workforce, and World

Posted on 04/04/2014 at 07:59PM

by Gib Bulloch | 10:00 AM March 31, 2014

We all know that education is an investment — but it’s not solely a personal one. The prosperity of nations and the health of economies is linked to the educational attainment levels and size of a skilled workforce.

For businesses, the danger of underinvesting in skills can be great. This was a major theme at the Global Education & Skills Forum last week in Dubai. At the forum we were reminded that the global economy is facing a “talent time bomb.” Whichever way you look at it, the countries producing the majority of the next generation of workers are still the ones least able to help them develop.

For example, the UN informs us that over the course of the 21st century, Africa’s share of the world’s population will nearly double, from 13.1 to 24.9%. Collectively, the UN projects, the less developed regions of the world “will grow 58% over 50 years, as opposed to 2% for more developed regions. Less developed nations will account for 99% of the expected increment to world population in this period.” Nigeria in particular (with a population projected to exceed that of the USA by 2050) will increase its workforce threefold in the next 50 years. Therefore we need to see significantly greater investment in the education systems of these parts of the world – and others. And not only for their own benefit, the economic fortunes of many other global regions depend on it.

As Sarah Brown, chair of the Global Business Coalition for Education, has said, “The evidence is clear for the business community that investing in education leads to a more relevant talent pool to drive societal and economic growth.”

Yet when we look at how corporate money is spent on social objectives, there is no evidence that education is being prioritized. On the contrary, healthcare spending by corporate donors is nearly 16 times higher than education spending. Given this, UNESCO’s recent call for 20% of global corporate philanthropic funding to be channeled to education projects is welcome.

But as good managers have discovered in so many realms of human need, pure philanthropy is not the only means for addressing social challenges. We need to remind ourselves that educating skilled workforces is an investment opportunity. And we need to focus on the aspect of the situation that surprises me the most: the lack of innovative financing mechanisms to allow investors (companies, individuals, or governments) to channel much needed funds to where we all know they will reap a reward.

For companies and other profit-motivated investors, investing in broad-based education presents some challenges. Developing talent is a long game, and skills gaps can take a generation to close. There is a “tragedy of the commons” problem, as well, whereby employers do not have to invest their own funds to enjoy the benefits of investments made by others. We generally see it as the duty of government to build schools, hire teachers, and provide access to education while businesses hire the best talent once it emerges. Where a business has engaged in “upstream” education, it has usually limited its involvement to short-term placements or CSR programs in the developing world.

But we can do better than simply throwing up our hands and leaving the hard investing to the public sector alone (an approach, by the way, that is costing governments $129 billion a year according to UNESCO).

There is progress being made. For example, new instruments known as “Social Yield Notes” could allow the funding of development to move from a model of bilateral grants and aid to an equity framework, where the value of the equity is determined as a function of the delivery of social outcomes. (A more detailed description of how a Social Yield Note could work, as well as broader discussion of what it will take to develop a new generation of talent, can be found in Investment in Global Education: A Strategic Business Imperative, a 2013 report compiled by Accenture Development Partnerships, the Center for Universal Education at Brookings, and Total Impact Advisors.) The broader point is that our finest financial minds are equal to this kind of investment challenge and could come up with increasingly sophisticated tools.

To be clear, this is not about privatizing state education systems. It is about mobilizing capital on a global scale to ensure that every child can have the right to a quality education. Delivered through education systems that are agnostic on the age-old debate of public vs private but with a singular focus on outcome and impact.

So what can the rest of us do to spur the development of better finance, and take investment and corporate involvement to the next level? At the very least, we should begin talking more about the investment opportunities presented by the education gap.

We can also point out how small changes can make very big differences. For example, when my colleagues and I looked at India, we noted that about two-thirds of children born there do not complete secondary education. But, according to the OECD, countries that are able to attain literacy scores even 1% higher than the international average will achieve 2.5% higher productivity rates and 1.5% higher GDP per capita than countries with average literacy scores. UNESCO research indicates that if only basic reading skills could be taught to the students in low-income countries, we would see 171 million people lifted out of poverty, which would constitute a 12% drop in the number of people living on less than $1.25 per day.

Finally, return on investment can be estimated and celebrated in various ways. Based on our data on Indian education costs, as well as revenues across industries, the case for private sector investment in education is strong. To take India as an example, as we do in our report, given an annual birth rate of 27 million, and a GDP per employed person of $8,939, it is simple math to calculate the “value gap” that results from that lack of access to quality education. It is over $100 billion (that’s over 5% of Indian GDP) each year. How many investment opportunities tap into such enormous potential value?

In conclusion: As some of us work on the kinds of financial instruments that will facilitate investment in global education, many more of us can work on shifting mind-sets. This is happening in many places, from Dubai to Davos (where it was discussed in several sessions this year’s meeting of the World Economic Forum). Change is underway but we must speed things up. Our future progress depends on it.

Tags: Talents, Loss of Human Potential, Developing Nations, Harvard Business School

Jetzt spenden

Jetzt spenden